4 segments of the network where NaaS makes sense for telcos

In the second part of this two-part blog series, Ryan Perera, Vice President & Country Manager, Ciena India, explains the Network-as-a-Service (NaaS) business model principles and four areas telcos can implement NaaS in their networks. This article was originally published on ET Telecom.

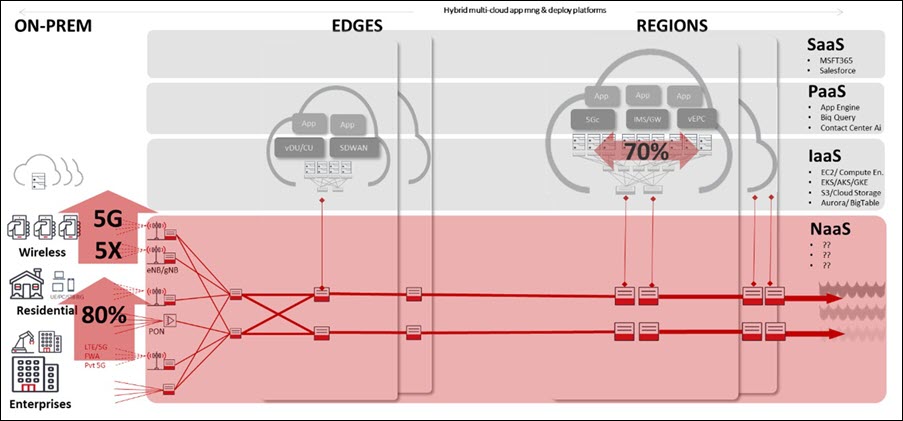

Over the past few years, public cloud providers have successfully mastered the art of delivering ‘flexible consumption-based business models, leveraging cloud-native technologies such as containerized microservices and analytics-driven automation to enable programmability and self-service.

For example, SaaS, PaaS, and LaaS are regular buzz words.

Now the question is … can the same principles be extended to the network by the telcos?

Network-as-a-Service (NaaS) is emerging as a promising business model to monetize the ever-increasing need for network connectivity for the ‘distributed cloud’.

Telcos need to make ‘consuming NaaS’ as easy as it is to obtain compute resources from public cloud providers.

Some of the necessary building blocks, such as programmable infrastructure, are already part of a telco’s digital transformation efforts. However, large-scale ‘traffic engineering’ and being able to apply Quality of Service (QoS) policies ‘on demand’ is foundational and needs more work.

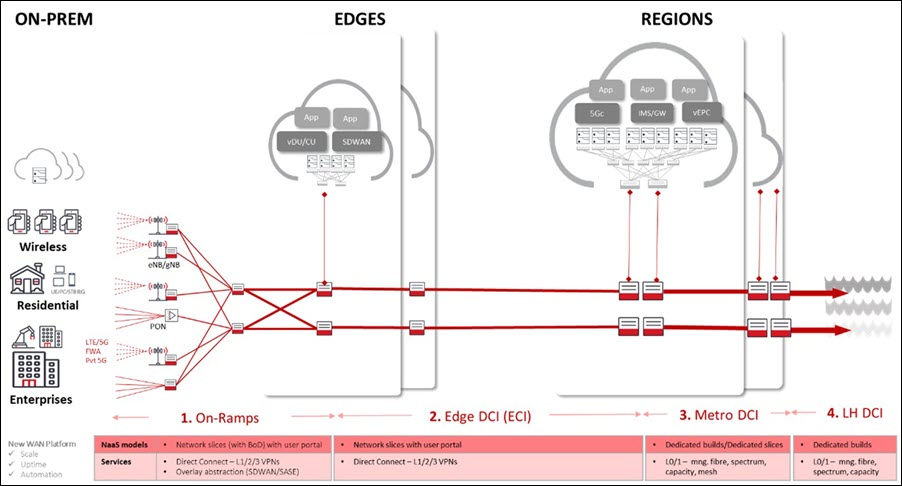

While there may not be a one size fits all NaaS model for all parts of the connectivity network, let's divide the network into 4 segments and explore how a NaaS business model could fit in:

Segment 1: On-ramps

This is the part of network where you connect end users (particularly enterprises) to multi-cloud environments. This is arguably the network segment that is most prime for NaaS business models.

Through various findings, enterprises have expressed their top NaaS priorities as security, Bandwidth on Demand (BoD), Virtual Private Network (VPN) with self-managed web portals for Service Level Agreements (SLAs), billing, and dynamic scheduling. Telcos could deliver flexible ‘network slices’ to the enterprises, which will provide connectivity to multiple public clouds (ex. connectivity to AWS Direct Connect. Azure ExpressRoute, or Google Cloud Interconnect). SD-WAN can also complement the above with overlay abstraction across multiple access options.

Segment 2: Edge Cloud Interconnect (ECI)

This is the part of network where you inter-connect Edge data centers. These edge locations are typically sub 1–3-megawatt capacity. Telcos are natural hosts for housing edge computing, thanks to their interconnects and points of presence in real estate. In this segment, NaaS based ‘network slices’ can be a game-changer.

Segment 3: Metro Data Center Interconnect (Metro DCI)

This is by far the most mature segment. Given the multi-terabit capacity and up-time requirements in this segment, we continue to see a lot of dedicated private builds. We also see multi-data center meshing with ROADM based optical switching. From a NaaS standpoint, we expect new ‘spectrum slicing’ business models emerge in this segment.

Segment 4: Long-haul Data Center Interconnect (DCI)

This is where you inter-connect regional data centers across long-distance and submarine networks. This segment also has ultra-high-capacity requirements and demands highest levels of spectral efficiencies. In this category, we will continue to see dedicated builds in the form of fiber, spectrum, and managed capacity.

Figure 2: This image represents the 4 segments where NaaS business models could fit in. In summary, the utility of this architecture is meant for:

- On-ramps is the network part where you connect end-users

- ECI is the network part where you connect edge data centers

- Metro DCI is the network part where you connect metros, and by far the most mature segment

- LH DCI is the network part where you connect regional DCs to long-haul and submarine networks

No one telco or cloud provider can cater to all cloud connectivity needs. Therefore, we need to establish more seamless Wide Area Network (WAN) sharing capabilities.

Telcos are already implementing several aspects of NaaS across various segments of the network. More work is needed in areas such as transport traffic engineering, user experience, and analytics-driven automation.

If these areas are addressed, telcos will be better able to monetize their Network as a Platform, which could very well be a telco’s real sustainable “edge” in this era of ‘distributed cloud computing’. On the other hand, telcos run the risk of further losing their network monetization capabilities below the ‘pipes’, into spectrum, fiber, or even the ‘right of way’ (RoW).